Which Accounting Software for Small Business is Best? A Complete Guide for 2025

Why Accounting Software Matters for Small Business?

Running a small business isn’t just about selling stuff or offering services. It’s also about keeping track of your money—who owes you, who you owe, and how much tax you need to pay. That’s where accounting software for small business comes in.

These tools take care of all the numbers, so you don’t mess up your finances. They help you:

- Send invoices fast

- Track income and expenses

- See real-time reports

- Handle tax without panic

You don’t need to be a math genius or hire an accountant right away. With the right software, even a solo entrepreneur can stay organized.

What to Look For in a Good Accounting Tool

Not all software is created equal. Some are easy, others are powerful. Some are made for freelancers, others for teams. Here’s what really matters:

- Ease of use: Can you learn it fast?

- Invoicing & billing: Can you send bills easily?

- Reports & analytics: Does it show clear profit and loss info?

- Tax tools: Is it VAT-ready, especially if you’re in the UAE?

- Mobile access: Can you manage on the go?

- Integration: Does it work with your bank or e-commerce platform?

Top Accounting Software for Small Business

Zoho Books

One of the most loved tools in the UAE, Zoho Books is packed with features and built for small business owners who want everything in one place.

Key Features:

- UAE VAT-compliant

- Clean dashboard with easy setup

- Automates bank feeds, recurring invoices

- Mobile app available

- Integrates with Zoho CRM, Zoho Inventory, and more

Why we love it: It’s perfect for small businesses in the UAE and connects beautifully with other tools in the Zoho ERP ecosystem. If you want smart software that does more than just accounting, this is a top choice. Start Zoho Books for Free Today.

QuickBooks Online

QuickBooks is one of the world’s most trusted names in accounting. Great for beginners and experienced users alike.

Key Features:

- Custom invoices and automatic reminders

- Tracks income, expenses, mileage

- Connects to banks and PayPal

- Generates tax reports and insights

- App available on Android and iOS

Good to know: Works well in the UAE but doesn’t support VAT by default—you need to enable and configure it manually.

Tally Prime

Tally Prime is a favorite among accountants in the UAE and India. If you want powerful offline software that handles complex accounting tasks, this is a strong pick.

Key Features:

- Great for managing inventory, payroll, and taxes

- Very accurate reporting system

- Strong compliance with UAE VAT laws

- Ideal for traditional businesses with in-house finance staff

One catch: It’s not cloud-based. So, it’s best for companies that don’t need remote access.

Xero

Xero is a sleek, cloud-based accounting tool built for modern businesses.

Key Features:

- Real-time data and dashboard

- Easy bank connections

- Beautiful invoice templates

- Supports multiple currencies

- Good mobile access

Best for: Companies that are growing fast and want smart integrations with payment gateways and CRMs.

FreshBooks

If you’re a freelancer, consultant, or small agency, FreshBooks is a great pick.

Why it works:

- Built-in time tracking

- Easy client invoicing

- Accepts online payments

- Expense management

- Simple tax summaries

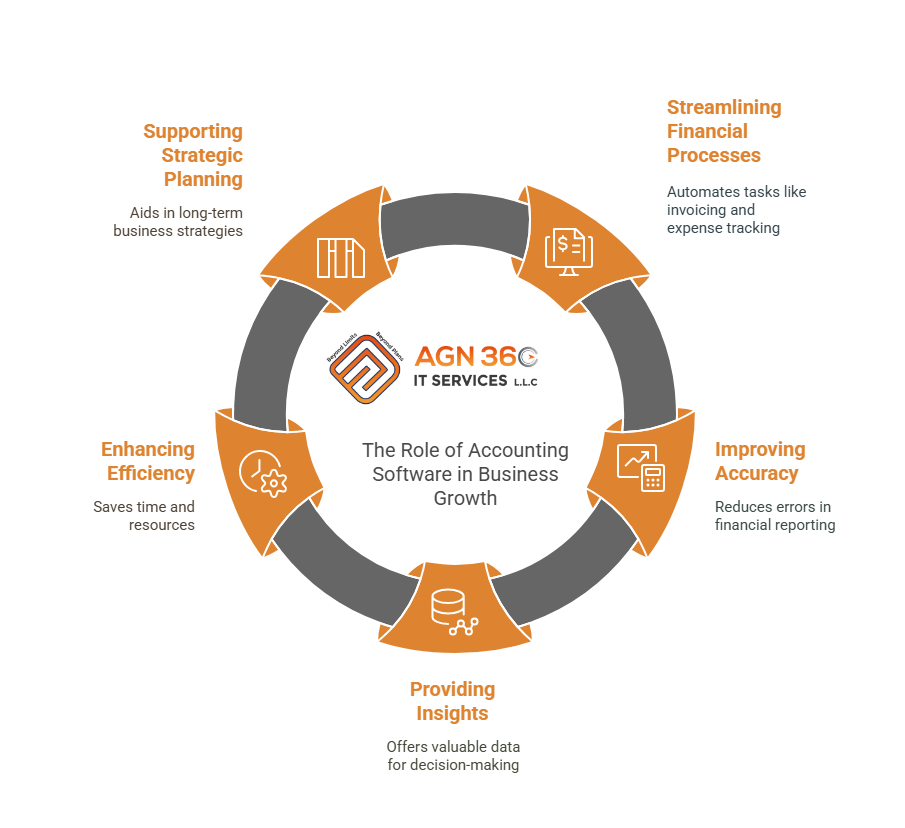

How Accounting Software Supports Growth

Automation, Reports & Tax Compliance

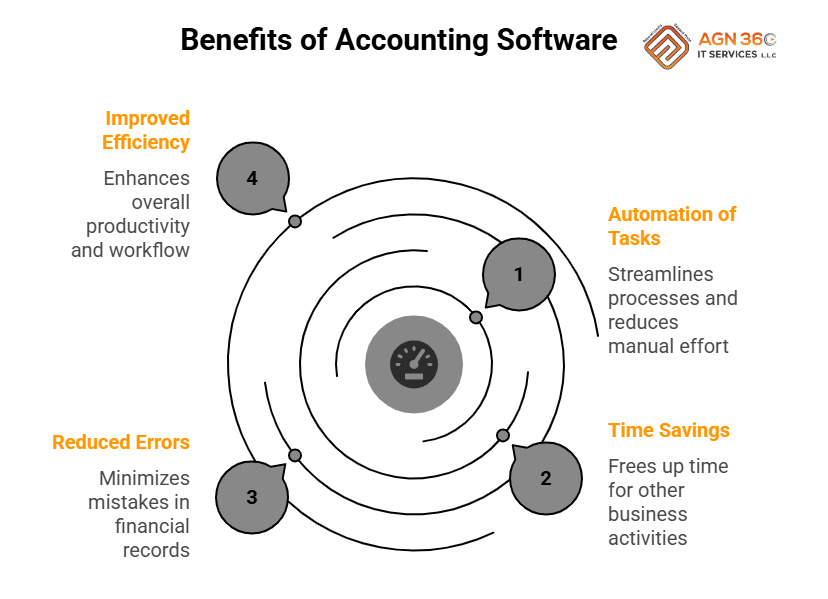

The best part about using accounting software for small business? It automates tasks that used to take hours. No more late-night invoice edits or spreadsheet headaches.

Here’s how it helps you grow:

- Saves time with automated billing, tax calculations, and reminders

- Reduces errors by removing manual entry

- Gives real-time reports that show profits, expenses, and trends

- Keeps you VAT-compliant in places like the UAE

Most of these tools also generate balance sheets, cash flow statements, and profit & loss reports with just a click—something every growing business needs.

Mobile Access & Integration with Other Tools

Modern accounting software works anywhere, anytime. Cloud-based tools like Zoho Books, Xero, and QuickBooks have great apps that let you:

- Send invoices while traveling

- Snap photos of receipts and upload instantly

- Check account balances and get alerts

- Sync with other tools like CRM or eCommerce platforms

When your software works on your phone, you don’t need to be tied to your desk. That’s a big win for small business owners on the move.

UAE VAT Compliance Benefits

If your business is based in Dubai or anywhere in the UAE, your accounting software must handle VAT. The best ones like Zoho Books and Tally Prime are 100% VAT-compliant, meaning they help you:

- Collect the correct VAT

- Generate FTA-approved tax invoices

- File returns easily

- Avoid penalties

That means peace of mind during tax season—and fewer surprises from the tax office.

Accounting Software vs. ERP Systems

When to Use ERP for Accounting

You might be wondering: Should I just use an ERP instead?

Here’s the deal—ERP systems do more than accounting. They also manage inventory, payroll, CRM, HR, and more. If your business is growing and you need more than just bookkeeping, an ERP with built-in accounting might be your next step.

Use ERP software when:

- You want one tool for everything—inventory, sales, HR, etc.

- Your business is expanding fast

- You need real-time coordination between departments

- You already use other ERP tools and need accounting to fit in

Pro Tip: Tools like Zoho Books can be part of a full ERP system, so you can scale as needed. Contact us Now

Best ERP with Accounting Features

Some of the best ERP platforms with strong accounting features include

- Zoho ERP Suite (with Zoho Books)

- Odoo (with accounting modules)

- ERPNext (full ERP + accounting)

- NetSuite (powerful but pricey)

If you need help setting up an ERP or connecting it with accounting tools, we highly recommend partnering with experts like Final Ratio Accounting and Bookkeeping Consultant; they provide full ERP integration services tailored for small businesses.

Using Accounting Firms for Setup & Support

Accounting software is great—but only if it’s set up correctly. If you’re not sure how to:

- Import old data

- Connect bank accounts

- Configure VAT correctly

- Link it with your other systems

…it’s smart to work with a professional firm.

Firms like Final Ratio Consultancy can help you install, customize, and train your team on the software. They also offer ongoing support so you’re never stuck when something goes wrong.

Real Stories + Decision Guide

Case Study: A Small Business in Dubai Goes Digital

Let’s talk about a real example. A local bakery in Dubai with just five employees was using paper receipts and Excel sheets to manage everything. That worked okay but as they grew, it became hectic. Mistakes were made, taxes got confusing, and they had no idea if they were making a profit.

They reached out to Final Ratio, an accounting firm in UAE, who recommended Zoho Books. After setup and training, everything changed:

- Invoices were sent on time

- Expenses were tracked daily

- Sales reports helped them plan smarter

- VAT returns were filed automatically

They now spend 50% less time on admin work and know exactly where their money goes.

This is the power of choosing the right accounting software for small business—and having the right support.

How to Choose the Right Software

Choosing the right tool depends on your business needs. Here’s a quick guide:

Business Type | Recommended Software | Why |

Freelancer | FreshBooks | Simple billing + time tracking |

Retail / E-Commerce | Zoho Books + Zoho Inventory | Invoicing + stock management |

Traditional SME | Tally Prime | VAT-ready, strong offline tool |

Growing Startup | Xero or QuickBooks | Cloud-based, smart integrations |

Service Provider | Zoho Books or Xero | Multi-currency, recurring billing |

Tips:

- Start with a trial version

- Check if it’s UAE VAT compliant

- Ask your accountant or firm like Final Ratio for advice

FAQ-Frequently Asked Question

What kind of support and training is available for new Zoho Books users?

We offer weekly ZOHO Clinic for our clients. We provide live support for all the client. This ZOHO Clinic not only allow our clients to connect to us live via zoom and get answers but also it help them to learn new things that may not be a problem for their business but other clients have faced it. Also Zoho Books includes 24×5 email support and live chat, plus an extensive knowledge base with tutorials and webinars. For hands-on guidance, our certified Zoho partner team in Dubai offers personalized training sessions, workflow customization, and post-go-live support to ensure your staff is fully comfortable and productive from day one.

How much does Zoho Books cost, and are there hidden fees?

Zoho Books offers transparent, tiered plans starting from 60 AED/mo (Standard) up to 90 AED/mo (Professional) in UAE, and comparable local pricing in SAR, USD, EUR, etc., with no hidden onboarding or support fees. All plans include VAT/ other taxes compliance features out of the box. Discounts are available when you subscribe annually, and you pay only for the modules you need. Its easy to upgrade or downgrade to any tiers as per your business requirement.

Can I migrate my existing accounting data to Zoho Books?

Yes. Zoho Books provides built-in data migration wizards and free migration support that let you import charts of accounts, customers, vendors, invoices, and historical transactions from popular platforms like QuickBooks, Xero, and Excel. Our implementation service ensures a seamless data transfer with zero downtime, so you can hit the ground running.

Do I need an accountant if I have accounting software?

Software helps, but an expert can save you time and catch mistakes. It’s smart to work with firms like Final Ratio and AGN IT Services for setup and tax filing.

Which accounting software are VAT compliant for UAE businesses?

ZOHO Books is the leading and most easiest accounting software that caters all the local regulations for all types of businesses in UAE. Other than ZOHO Books there are few other software like Tally, QuickBooks etc.